WhatsApp Fraud

Discover how we dropped frauds by 90% with a simple solution.

Company

Marktplaats

Context

With over 8 million unique visitors monthly and 4 new ads being posted every second, Marktplaats facilitates the resale of everything from furniture to cars. In 2021, I was responsible for our Trust and Safety team; and we faced a huge problem when 60% of all phishing frauds in the Netherlands could be traced back to us. So, we needed to act on it.

What I did

— Problem exploration

— User interviews

— Ideation

— Prototypes

— Implementation support

The problem

In 2021 we were seeing a huge amount of reported Whatsapp Fraud cases. This is when a fraudster tries to get a user off our platform to another - such as whatsapp - and proceed to defraud them. In most cases, via a fake payment link. It's particularly damaging because we can’t protect users once off our platform, we can’t identify who the fraudsters are, and the customer losses are high.

60% of all NL payment fraud

Local authorities in NL could link 60% of all payment frauds back to Marktplaats.

>500K in customer damages

The damage to customers was estimated around 500-800K euros monthly, by the local authorities.

User post an AD exposing their phone number

Receive a message via WhatsApp to confirm their bank details using a (fake) link

Their bank account is emptied by the fraudsters

Solution exploration

We explored different solutions, but for the reasons below, we couldn't implement those at that time.

Offering phone masking solution

Needed a 3rd party solution at the time, and was harder to implement.

Additional verification methods

Asking for ID, biometrics or other methods needed a 3rd party integration and could hurt the number of new users.

Improving the chat

It would be good in a long term, but would take too much energy and time (that we didn't have) to start working.

Removing phone numbers

Sounds obvious, but we had a metric called vibrancy, that was about people connecting with each other. And revealing phone numbers counted as part of it. So, nope.

We knew we couldn't stop WhatsApp fraud, but we could reduce it with education. One of the many ways of educating someone, is by introducing some desirable difficulties, when by taking extra steps, we give our users more control, time and opportunities to think about their actions and possible consequences.

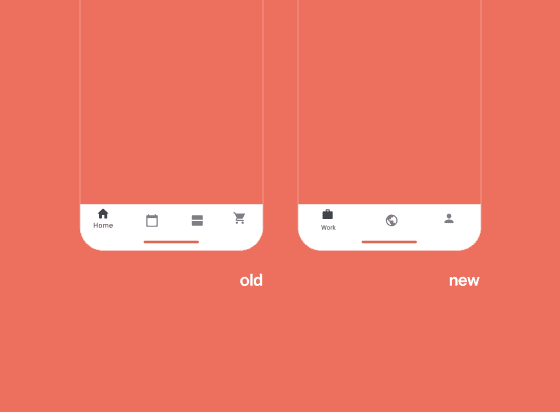

We introduced this intentional friction on our listing page, where a seller sets their goods properties and trading preferences. Before, we presented a field with a telephone number that people would fill by default, even that it wasn't mandatory (as we discovered talking with users).

And now, when you reach this part, you have a switch to enable the telephone field. And for the first time you do it, you must see two different modals explaining the risks of sharing your telephone and trading outside.

Validating

Talking about fraud was a new area for us, so before any development was done we interviewed 6 users from different backgrounds and tested concept perceptions with more than 240 users. We made some tweaks based on their feedback and finally rolled out our A/B tests in production.

To ensure the product feature would have maximum impact, we created a campaign in collaboration with our marketing team which was released alongside our A/B tests. Again, this was new for us, which was a bit scary - as we were actively communicating with customers about fraud on our platform for the first time. But the results we saw were great - we drove hundreds of thousands of views of our Whatapp Fraud landing pages, and only received one negative complaint. This was a bit of a lightbulb moment for us, as we realised that fraud really shouldn’t be a taboo subject.

Quotes from our interviews

"I see it as Marktplaats is giving me the choices to show my info, it appears to be safe. "

Tamara - 43

"It was good to have the modal for the first time because people wouldn't need to go to find it by themselves "

Tjinske - 29

Mohammed - 43

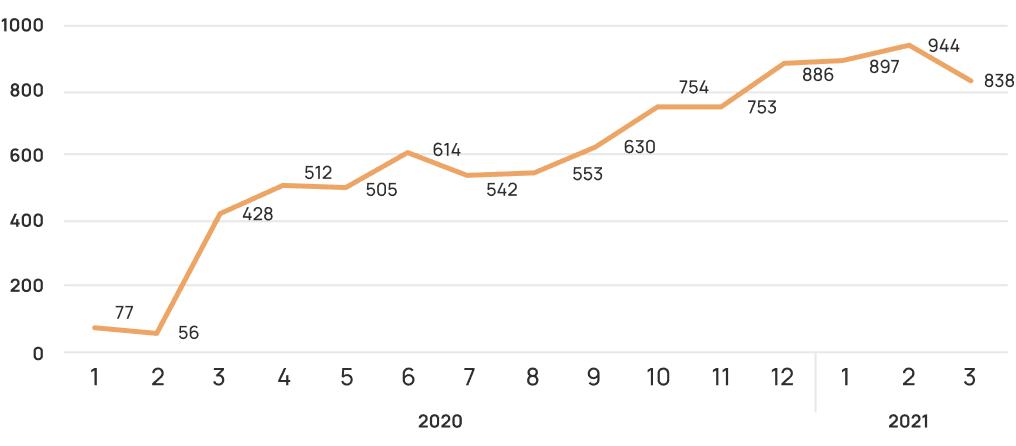

Final results

Our A/B experiments were in place to make sure we didn’t damage core metrics whilst creating desirable difficulties in one of our core flows. Here we succeeded. Although there was a big drop in phone replies, we actually saw a shift to more users trading through our chat. We see this as a win-win situation. We keep more users on our platform, so they can be kept safe, but it also gives us the opportunity to have them adopt our transactional services. We therefore rolled this out to 100%.

The big outcome however, came at the end of year when local authorities shared the updated numbers of payment fraud. The product work we did, combined with the efforts from marketing, saw the number of cases of payment fraud from our brands fall from over 1200 a month down to under 100.

Lessons I learned

Next steps

Once we learned that education would really be a good aim to tackle fraud, I did a workshop with the trust and safety team (in person), so we could emphatize with our buyers and sellers issues and think about might we educate them to reduce the problems and anxieties. From this workshop we collected some ideas that became part of our roadmap.

Did you liked it?